Bangladesh’s capital market once again best in world by Shibli Rubaiyat’s Magic

Even in the Corona period, Bangladesh set a new record by leaving the other capital markets of the world behind and getting a place in the best list again. In terms of returns, Bangladesh's capital market has risen to the top of the world list for the third time.

Even in the Corona period, Bangladesh set a new record by leaving the other capital markets of the world behind and getting a place in the best list again. In terms of returns, Bangladesh's capital market has risen to the top of the world list for the third time.

This information has come up in a report published in the Frontier Journal recently.

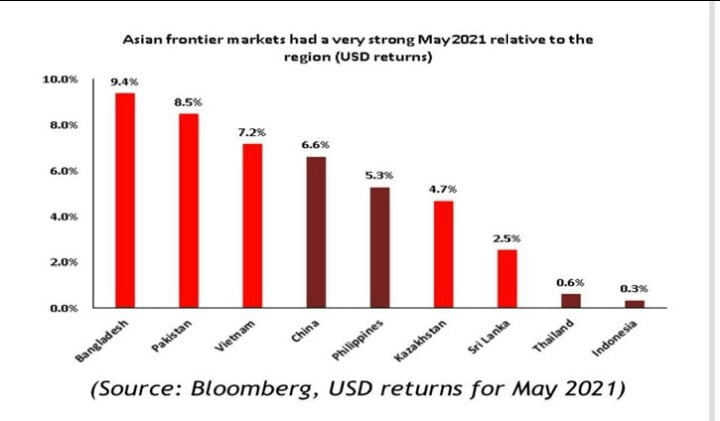

According to the report, investors received a return of 9.4 percent from the capital market of Bangladesh during the period under review. Besides, Pakistan is 8.5 percent and Vietnam is 7.2 percent, China is 6.6 percent, Philippines is 5.3 percent, Kazakhstan is 4.7 percent, Sri Lanka is 2.5 percent, Thailand is 0.6 percent and Indonesia is 0.3 percent.

Commenting on the report, Professor Shibli Rubaiyat-ul-Islam said the broad index of the Dhaka Stock Exchange had risen sharply in May as investors' confidence was restored even amid the Kovid-19 epidemic. As a result, Bangladesh is at the top of the world's best performance indicators.

Banks in Bangladesh have reached the top of the list in terms of returns due to low interest rates, positive trend in exports and remittances.

Analysts say’s the market has returned to a positive trend since the new commission headed by Professor Shibli Rubaiyat-ul-Islam took office. Domestic and foreign investors are flocking to the market. As a result, the market index crossed a record 6,000 points. And investors have got good returns from such markets. Besides, the present commission has taken various initiatives for the development of the market.

Multinationals, government and domestic-foreign good fundamental companies are trying to get listed through initial public offering (IPO). At the same time, the commission is working to ensure transparency and accountability in the market. If these works can maintain the confidence of investors in the capital market, Bangladesh will be able to hold a place in the best list in the future as well.

It is to be noted that the capital market of Bangladesh occupied the best place in the world in September and October last year.

Sunbd/NJ

Copyright © 2026 Sunbd24. All rights reserved.