Trying my best to bring a good IPO: BSEC chairman

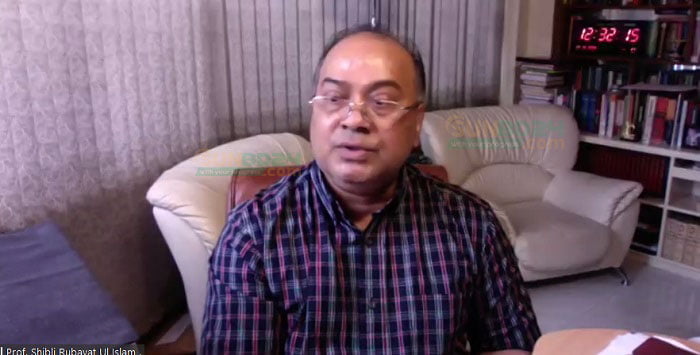

Professor Shibli Rubaiyat-ul-Islam, chairman of the Bangladesh Securities and Exchange Commission (BSEC), said he was doing his best to bring a good IPO to the capital market.

Professor Shibli Rubaiyat-ul-Islam, chairman of the Bangladesh Securities and Exchange Commission (BSEC), said he was doing his best to bring a good IPO to the capital market.

He said he was reviewing the company's past years' business in approving IPOs. In particular, I am analyzing the company's paid-up capital, 5-year tax record.

He was speaking as a special guest at a virtual seminar on "Towards Sustainable Development of Capital Markets" on Saturday (October 31st).

The seminar was organized by Bangladesh Merchant Bankers Association (BMBA) and Capital Market Journalism Forum (CMJF).

Adviser to the Prime Minister Salman Fazlur Rahman is the chief guest.

Noting that we will not waste any time in approving the IPO, the BSEC chairman said, "We will approve the IPO to the applied company within a month, not in three months, if all the paperwork is in order." The last three to four years of frozen IPO applications are almost over. New companies that apply will be approved soon. In that case not three months, approval will be given within one month if the documents are correct.

Regarding mutual funds, he said that in the last few years, many funds are not giving any return to investors, which is not right. At this time many mutual funds are paying dividends but some funds are not. I want to give the real form of mutual fund in the capital market for the market, not under any pressure.

BSEC Professor Shibli Rubaiyat-ul-Islam said, “We want to make mutual funds more popular. In the last few years, many funds have not been giving investors a return. That's not right. At this time many mutual funds are paying dividends but some funds are not.

FBCCI President Sheikh Fazle Fahim and Dhaka Chamber of Commerce and Industry (DCCI) President Shams Mahmood were present as special guests at the seminar.

The original article was presented by the first vice president of BMBA, Md. Moniruzzaman, FCA.

Bangladesh Merchant Bankers Association (BMBA) President. Chayedur Rahman and Hasan Imam Rubel, President of Capital Market Journalism Forum (CMJF) conducted the event.

Sunbd/NJ/4:37/10.31.2020

Copyright © 2026 Sunbd24. All rights reserved.