Students Tk1,700cr crossed from School Banking deposits

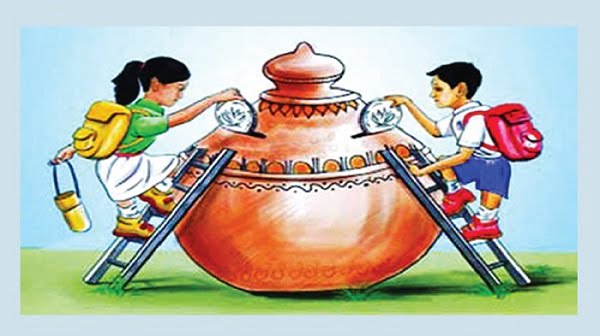

between 11 and 17 years aged Any student can open an account under the School Banking scheme

Across the country school Banking scheme is gradually becoming popular among students , as their deposits with the banks crossed Tk1,700 crore at the end of March, this year.

The banking scheme system teaches students useful skills to effectively manage money. As part of the program, students deposit their savings at banks with a hands-on banking experience in a simple way, according to experts.

At the end of March, a total of Tk1,724.63 crore was deposited from 2,329,131 school banking accounts at 55 scheduled banks, according to data collected from Bangladesh Bank.

During January to March of this year, the deposited amount and accounts increased by 6.09% and 16.87%, respectively.

The central bank data showed that Tk1,444.14 crore was deposited from 1,612,113 accounts of private commercial banks, which was 83.74% of the total school banking deposits.

On the other hand, Tk217.88 crore was deposited from 573,465 accounts in state-owned commercial banks, which was 12.63% of the total school banking deposits, as mentioned in the central bank’s latest quarterly report on financial inclusion.

Dutch-Bangla Bank is the top bank in terms of mobilizing deposits under the school banking scheme. The bank holds 28.57% share in case of deposits.

Dutch-Bangla Bank Ltd (DBBL) Managing Director Abul Kashem Md Shirin said: “We are the first bank to introduce school banking.”

DBBL holds programs at schools on a regular basis in order to raise awareness on building habits of saving money among the students, he added.

“Bangladesh Bank launched School Banking in November 2010 for school students to help them save up for the future, as well as to learn financial literacy at an early age and establish the habit of saving,” a Bangladesh Bank official said.

Sources from the central bank said any student, aged between 11 and 17 years, can open an account with banks supporting the service. The account can also be opened at ease with three copies of photo of the account holder and a written consent for the parent. This is basically a joint account between the student and the guardian.

There are some advantages of opening this account, such as waivers of fees and charges, free internet banking, a waiver of minimum balance requirement, debit card at lower costs, etc, sources added.

Former Bangladesh Bank governor Dr Atiur Rahman said: “Student banking is now popular because of the central bank’s initiatives. As student deposits are increasing by the day, Bangladesh Bank should play a more effective role to promote the service across all districts.