A budget amid Covid-19 pandemic

Finance Minister AHM Mustafa Kamal, MP proposed allocation of a significant amount of fund in the budget for the fiscal year 2020-21 to face the challenges posed by the Covid-19 pandemic. Tk 100 billion has been allocated under a stimulus package to fight the deadly virus and re-build the economy and ensure its sustainability after the damage done by the pandemic.

Finance Minister AHM Mustafa Kamal, MP proposed allocation of a significant amount of fund in the budget for the fiscal year 2020-21 to face the challenges posed by the Covid-19 pandemic. Tk 100 billion has been allocated under a stimulus package to fight the deadly virus and re-build the economy and ensure its sustainability after the damage done by the pandemic.

Allocations for the Health Services Division and Health Education and Family Welfare Division in the fiscal year also increased to Tk 292.47 billion.

How the Tk 1.9 trillion (1,90,000 crore) deficit will be managed: Out of the total deficit, Tk 800.17 billion (80,017 crore) will be financed from external sources, while Tk 1.09 trillion (1,09,983 crore) will come from domestic sources including Tk 849.83 billion (84,983 crore) will come from the banking sector and Tk 250 billion (25,000 crore) from savings certificates and other non-bank sources.

Corporate Tax: Appropriate focus has been put on the tax rates to help the economy recover from the unexpected fallout due to the pandemic. Some positive changes took place in the corporate tax rates.

* publicly traded cigarette manufacturers and a 20% tax on dividend income of companies.

* supplementary duty (SD) on cigarettes is likely to be increased by 10-15%, while an additional 5% SD is likely to be levied on mobile phone talk time.

Personal Income Tax: The tax-free income limit for individual taxpayer has been increased in the proposed budget for FY 2020-21. The tax-free income limit for on individual has been increased from Tk.250,000 to Tk 300,000. An individual who earns Tk 300,000 annually will not have to pay any tax. The tax-free income threshold for female taxpayers and taxpayers above 65 years of age has been fixed at Tk 350,000 up from Tk 300,000. In the budget speech the minimum tax rate for individuals has been proposed to be reduced from 10 per cent to 5.0 per cent, and the maximum tax rate for individuals from 30 per cent to 25 per cent.

Initiatives to develop the stock market: The budget allowed investment of black money in the capital market on payment of Tk at the rate of 10 per cent. The Budget speech included the government steps to enhance participation of banks and non-bank financial institutions in the capital market, ensure easy credit facility for merchant bankers and institutional investors, boost the investment capacity of state-owned Investment Corporation of Bangladesh and enhance increase institutional investment and ensure listing of multinational companies and local big corporates like Akij, City, Partex and state-owned enterprises to increase the depth of the stock market.

Bangladesh Bank now allows scheduled banks to invest Tk 2.0 billion (200 crore) each in the stock market taking financial support from the central bank. Banks will be allowed to show the fund as special investment, which will not fall under the purview of the banks' stock market exposure of up to 25 per cent of their capital.

The incentives offered in this budget are: dividend income from the listed companies has been made tax-free up to Taka 50,000, and double taxation on dividend from listed companies has been removed. Declaration of cash dividend for at least 50 per cent of the profit of listed companies has been made mandatory.

Whitening black money made lucrative: Individual taxpayers between July 1, 2020 and June 30, 2021 will be allowed to disclose any type of undisclosed property by paying a certain amount of tax per square foot; declare undisclosed cash, bank deposits, savings certificates, shares, bonds or any other securities by paying 10 per cent tax; and invest money in the capital market by paying 10 per cent tax on the value of the investment.

"No authority, including the income tax authority, can raise any question on such declarations," said Finance Minister AHM Mustafa Kamal in his budget speech.

But offering the money whitening facilities would discourage honest taxpayers in paying their taxes. Besides, the offer might encourage the unscrupulous persons to siphon off the money abroad intensifying the illicit capital flight from (ICF) Bangladesh.

Washington-based capital flight watchdog, Global Financial Integrity (GFI, December 15, 2014)) ranked Bangladesh 51st among 145 countries adversely affected by ICF. According to GFI, capital flight from Bangladesh tripled to USD 1.78 billion from its 2011 estimates of USD 5,931 million - a 200 per cent jump. Over the 2001-2010 period the country lost around USD 14 billion in ICF, of which 75 per cent (or USD 10.5bilion) was stolen through manipulation of export and import invoicing.

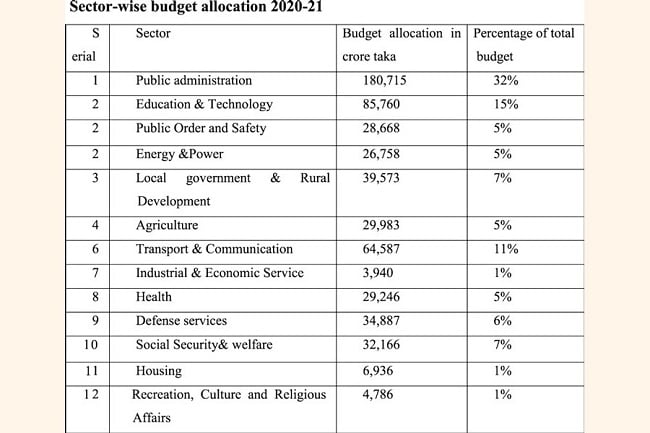

Total budget allocation: The budget 2020-21 must be appreciated because the preparation of this budget was really a difficult task unlike the budget in a normal situation. This budget has been placed to do a lot to fight the unprecedented pandemic.

The Finance Minister could properly have addressed and considered reducing the rates of corporate and as well as personal income tax as expected by the corporates and individuals! Therefore, the budget should not make them unhappy.

Challenges of this budget: * It would be a great challenge to achieve the target of 8.2 per cent GDP growth due to the world wide economic fallout.

* Achieving revenue target would be a great challenge because collection of tax revenue would be tough due to the uncertainty posed by the pandemic.

* Uncertainty looms large over maintaining the target rate of inflation at 5.4 per cent because a big risk is associated with the budgeted fund flow as the virus goes virulent.

All challenges predicted depend on the easing of the prevailing pandemic and we pray to Almighty Allah that we can overcome this pandemic, worst of its kind in the last 90 years history.Report:TFE

Copyright © 2026 Sunbd24. All rights reserved.